Council took £1.8 million in spy camera fines which may have to be refunded

Social care budgets were over spent by £1.3 million last year with Environmental Services (mainly waste collection) clocking up a £443,000 and Children’s Services/Education a £309,000 loss.

Overall York Council Departments spent £1.7 million more than had been budgeted.

The budget broke even only because of a £2 million surplus on “centrally administered” budgets.

The figures are revealed in a report to be considered by the Councils “Cabinet” tomorrow (Tuesday)

As previously reported, the biggest problems arise in Social Care where the Council reveals overspends on community support (£236k) due to a higher number of customers than forecast, a continued increase above forecast level in the number of customers taking up Direct Payments (£129k), increased use of external placements for emergency and short term breaks (£252k) and a higher than budgeted number of customers in residential nursing placements (£718k).

The Councils financial position was saved only because it continued to enjoy the benefits of low interest rates on its borrowing (equivalent to a £990,000 budget saving).

It achieved only 73% of its planned capital investment programme storing up a massive £83 million backlog in work which it says it will try to address during the current financial year.

The government gave the City an extra £732,000 to reduce the Rate burden on small businesses although there has been a slow take up on this important concession.

The position is also masked by £1.765 million in fines income received from spy camera use in the Lendal Bridge and Coppergate.

The Council has now admitted that the trials cost a whopping £718,000 to implement. £1.047 million has been put in a reserve account which will presumably be used to refund fines imposed unlawfully.

The balance would have to come from Council taxpayers (the equivalent of a 1% rise in Council Tax levels).

The spy cameras on Lendal Bridge have been removed while those on Coppergate were switched off on 1st April.

The housing revenue account (Council house rents income) showed a £12.1 million surplus at the end of the year.

The report to the Cabinet pointedly fails to contain performance data on the quality of public services being provided to York residents.

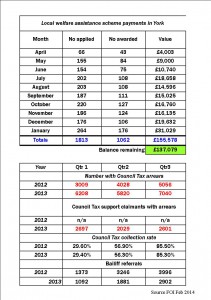

NB As at April 1st 2014, 6717 York Council Taxpayers had arrears of £ 4,769,989.36