£1000 a year benefit for York businesses

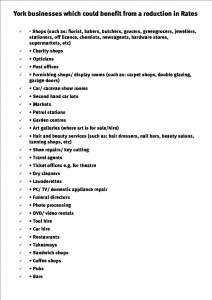

List of qualifying business types. click to enlarge

The Government announced in its Autumn Statement on 5th December 2013 that it will provide relief of up to £1,000 to all occupied retail properties with a rateable value of £50,000 or less in each of the years 2014-15 and 2015-16.

Potentially as many as 1700 York businesses could benefit

The purpose of this new relief is to support the ‘high street’ which has been affected by changes in consumer spending preferences such as online shopping. The relief is temporary for two years from April 2014.

A wide range of businesses could qualify for the reduction (see list right)

Areas like Front Street in Acomb are likely to benefit from the scheme.

It will be necessary for any business wishing to claim this relief to make an application to the council and complete a state aid declaration form.