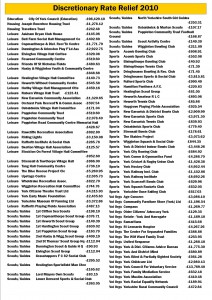

Over 100 local organisations receive rate relief on premises that they occupy in the City. An 80% discount is available under national legislation but the local Council can increase this to 100% if they choose to.

This 20% is known as “discretionary rate relief”.

Organisations must be non-profit making. The level of their revenue reserves must not be in excess of:

– 10 times the amount of the gross rates payable, or

– £10,000

(whichever is the higher).

Organisations must be primarily for the benefit of people who live or work in York.

The Council is proposing to reduce the budget available for this discretionary relief by £54,000 with effect from April 2013.

At the moment 103 organisations qualify for relief, they cover a wide range of organisations many of which are charities. They include sports, leisure, scouting and educational bodies.

In total, in excess of £200,000 was rebated last year.

Amongst the qualifying organisations are the Foxwood Community Centre, the Acomb Bowling Club, the Dringhouses Sports & Social Club, York Indoor Bowls and Social Club and the Acomb Sports Club.

The Council, have not indicated which organisations they intend to target but Labour in the past have hit organisations which are not registered as charities. Sports bodies with clubrooms are thought to be particularly vulnerable to losing the relief.