There is something rather ‘Alice in Wonderland’ about the current UK economic debate. The Coalition argues that it is taking historically tough action to bring down the deficit and curb the national debt. The evidence just does not support this assertion. Labour meanwhile asserts that it is the Coalition’s fiscal toughness which has driven the UK back into recession, even though the differences between the Coalition’s approach and Labour’s are minimal.

In short, it suits both sides in this argument to pretend that the dividing lines between their two economic approaches are wider than they are: it maintains the pretence that the electorate faces a great ideological choice between the Coalition and Labour. This illusion is promoted by a media which is also much happier to portray imagined conflict than it is to present the messy reality.

The closer reality is that neither the Coalition nor Labour is at all sure how to respond to the current economic slowdown. The growth of the Blair/Brown years was driven by a massive expansion of personal and government debt, as Tim Morgan has noted here in his pamphlet The Quest for Change and Renewal:

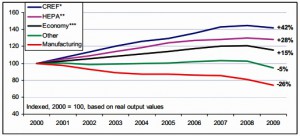

Between 2000 and 2009, the big drivers of the economy were private borrowing and public spending. Reflecting this, the CREF (construction, real estate and finance) sectors expanded rapidly on the back of private borrowing while big increases in real public spending drove up output from HEPA (health, education and public administration) … the rapid growth between 2000 and 2009 in both CREF (+42%) and HEPA (+28%) masked a languishing in the rest of the economy (–5%), with real output from manufacturing plunging by 26%.

These differential rates of growth left a huge proportion of the economy incapable of growth. In 2009, the public spending driven HEPA sector accounted for 19% of all economic output, whilst borrowing-dependent CREF activities represented a further 40%. Add in a retail sector beleaguered by the squeeze on real disposable incomes and almost 70% of the economy is incapable of growth. Thus seen, Britain’s growth prospects are grim, because a huge proportion of the economy is skewed towards, and dependent upon, the dead-and-buried drivers of private borrowing and public spending. And growth is critical to the Coalition’s fiscal plan, because that plan cannot work unless revenues increase in response to a brisk expansion in output.

The usual attempts at an economic fix have failed, as consumers, companies and government de-leverage after a decade or more of maxing out their debt. The Government (both Coalition and then Labour) has tried to boost private spending by keeping interest rates at close to zero, while the Government (both Coalition and then Labour) has injected huge sums of public money into the economy — some £825bn through a combination of deficit spending and quantitative easing. So far none of this has worked, though it may of course have prevented the situation from becoming even worse.

Conclusion

The first step toward a diagnosis is to acknowledge the extent of the problem. Yet that isn’t currently happening in our debates on the economy. Political debate instead turns on the minute differences which separate the Coalition’s and Labour’s remarkably similar economic approach.

It suits the political parties, and it suits the media. But as a result myths are taking hold — that the Coalition is embarking on ‘slash and burn’ austerity, or that the national debt is being wiped clear — which distort the reality of the situation. And this only makes it harder to begin grappling with our problems.

http://stephentall.org/