The amount that central government pays the York council to provide public services will be reduced by 1.1% for the next financial year. This is significantly lower than the national average reduction (1.7%). It compares with a 2.5% reduction in North Yorkshire and a 2.3% reduction in Leeds. http://tinyurl.com/Grant-comparisons

The reduction is offset by increased grants for education. York does well out of the revised pupil premium allocations which will help to address poverty concerns in the City.

In addition the City will benefit from additional income for the provision of additional homes (the new homes bonus)

At least 50% of any increase in Business Rates income will also be retained in the City.

The new funding system means that 70% of expenditure in City’s like York will be locally funded meaning that the Council has more control over the financial strategy of the City.

However, the present Labour Council has been heavily criticised for prioritising “vanity” projects like the proposed “arts barge” while substantially increasing the amount that the local authority is borrowing.

It is the repayment on this additional debt that could prove to be a millstone around the necks of successive generations living in the City.

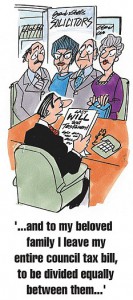

The government has also announced that funding will be available for the next two years to freeze Council Tax levels. The Council in York spurned a similar offer last February introducing a 2.9% Council Tax increase. It remains to be seen whether the prospect of funding for 2 years will prompt a different reaction. If not residents face a 2% increase in Council Tax in April 2013 and a further hike a year later.

The Council have also turned down government grant payments which would have seen any reduction in Council Tax benefit entitlement, for the less well off, limited to 8%.

http://tinyurl.com/York-grant

http://www.local.odpm.gov.uk/finance/1314/plainenglishguide.pdf