The Council Leader James Alexander has been quoted in a radio interview as saying that one of the objectives of the new Local Plan building allocations (1090 new houses per year) is to “stabilise house valuations in York”.

We have news for him.

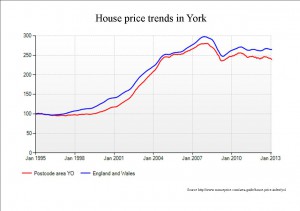

House values have been “stable” in York for over 4 years now.

In the last 5 years prices in the YO1 post code area have actually fallen by 14%.

They are down by 1% during the last 12 months.

One St Stephens Road property – bought for £135,000 on 15th August 2012 – sold on 13th Feb 2013 for only £120,000. A drop in value of 11% in less than a year. Click here for more examples

Indeed, immediately after the Labour government presided over the collapse of the UK economy, many York home owners saw the value of their property decrease.

It means that those who bought in the middle of the last decade are already in a position where their homes are worth less than they paid for them.

Around 10% owe more on their mortgages than the current value of their homes. They are effectively trapped in what is known as “negative equity”.

Labours plan is to unleash a glut of cheap(er) new property on the market. That means a further tumble in the value of existing homes. It means more people being unable to move because they cannot pay off their existing mortgages.

So will 1090 homes be built each year?

Initially the Local Plan strategy might see some developers building on newly released greenfield sites.

Generally greenfield sites cost less to develop than brownfield (previously developed) sites.

They offer none of the problems involved in demolition of existing buildings or addressing contamination issues.

Unless the council actually tries to charge the developer for off site improvements to the A1237 (dualling would cost £240 million), then the site they are supporting at Woodthorpe could be particularly attractive.

Development would take place there in preference to the unused and largely derelict site behind the station (York Central) where the cost of providing new access bridges make it an expensive option. The effect of the plan would be that York Central would not be developed for housing for over 15 years – perhaps never.

However, major housing developers seek to make a profit. While a return to average building levels of around 650 units a year could happen as the economy improves and mortgages become more affordable, builders will not develop unless they are confident of sales.

Even the building bubble in the period from 2000 – 2007 saw most investment go into flats. It eventually reached a point where demand for the flats was satisfied. Many developments lay empty for a while at least. Developer enthusiasm evaporated and even good quality sites like Hungate proceeded only slowly.

So how will it affect me?

Site costs can account for around 30% of the sale price of a home. If a glut of cheap homes hits the York market in a short period of time, then existing property values are likely to reduce by between 10% and 20%.

“Good” those that are entering the housing market as first time buyers may say.

But for these why have struggled to get onto that first rung over the last decade it will be a disheartening kick in the teeth.

For those living near the newly released housing sites it means a blight on their property, a lower property valuation, the inconvenience that large scale building always brings plus the prospect of a further decline in local public service standards.

…..and those seeking first time mortgages may find that lenders reduce the proportion of the cost that they are prepared to lend on give the new volatility of home values in the City.

We don’t really know whether the present Council leadership is naive or just plain gullible.

But they are clearly out of their depth if they are trying to manage the local housing market.